On the morning of January 2 this year Kyiv survived the biggest missile attack since the full-scale invasion started almost two years ago. On average, Russia kills six Ukrainian civilians and wounds 20 every single day. The continuation of Moscow’s illegal war of aggression has been made possible by the growth of its fossil fuel revenues and imports of critical Western equipment and technology for its military.

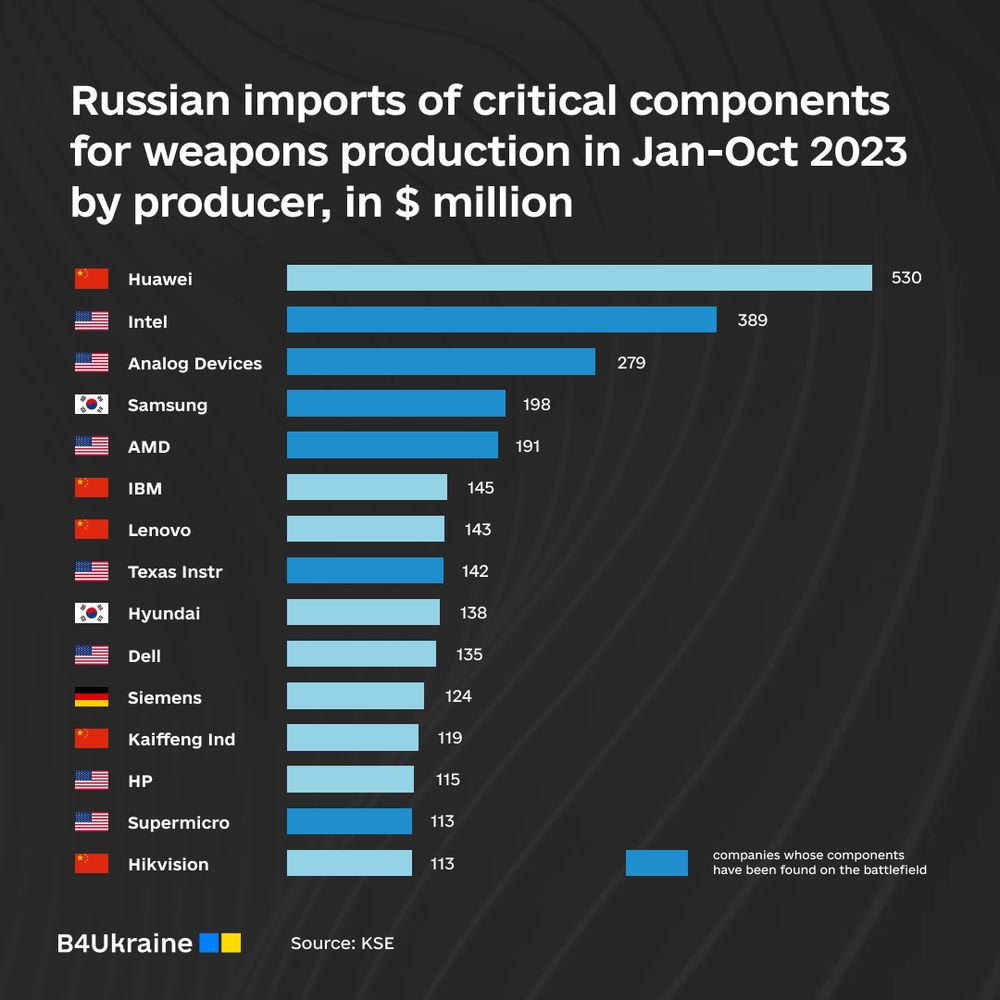

In 2023, at least one-third of Russia’s foreign-sourced components critical to its war effort came from companies headquartered in the US and its allies. This translates into $7.3 billion, according to a recent study by the Kyiv School of Economics and Yermak-McFaul Group, which analyzed 485 components.

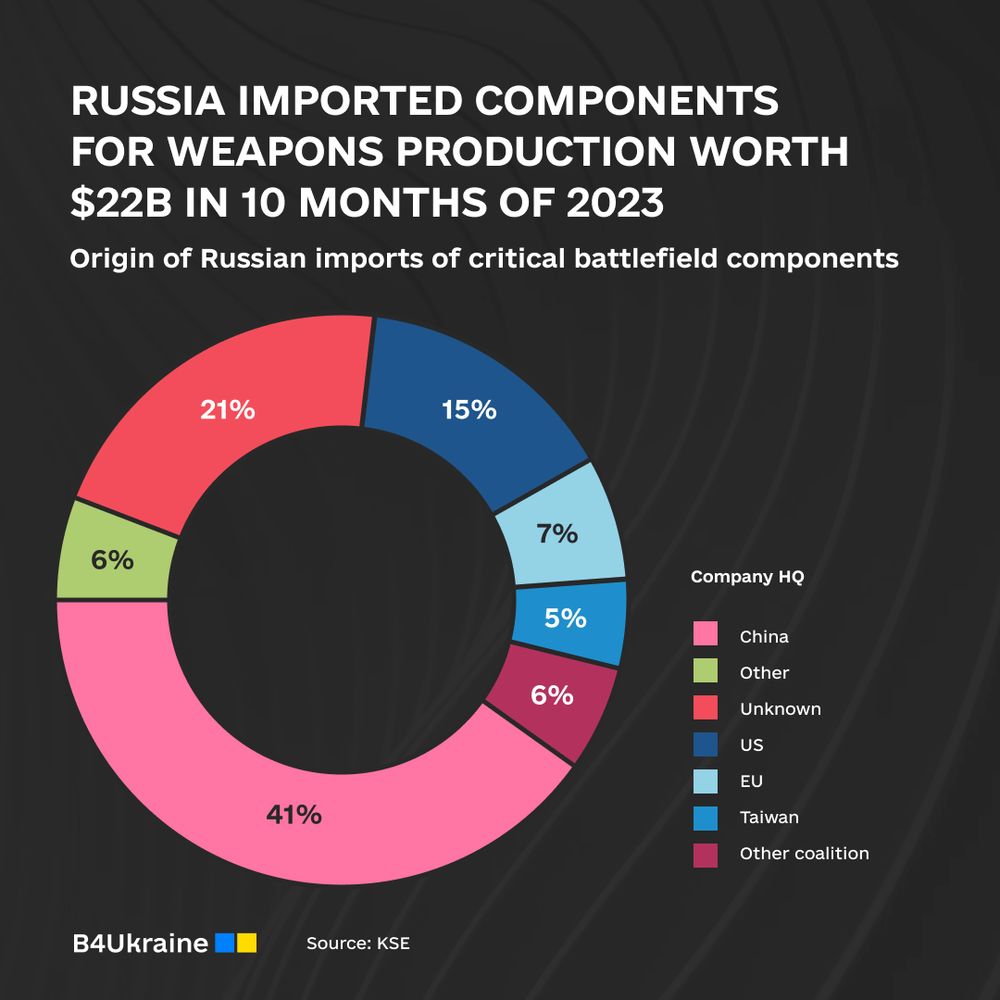

Between January and October of 2023, Russia imported $22.2 billion in semiconductors, electronics, computer and automotive components, bearings, communications technology and other critical components. These are so-called dual-use goods — items that can be used for both civil and military purposes.

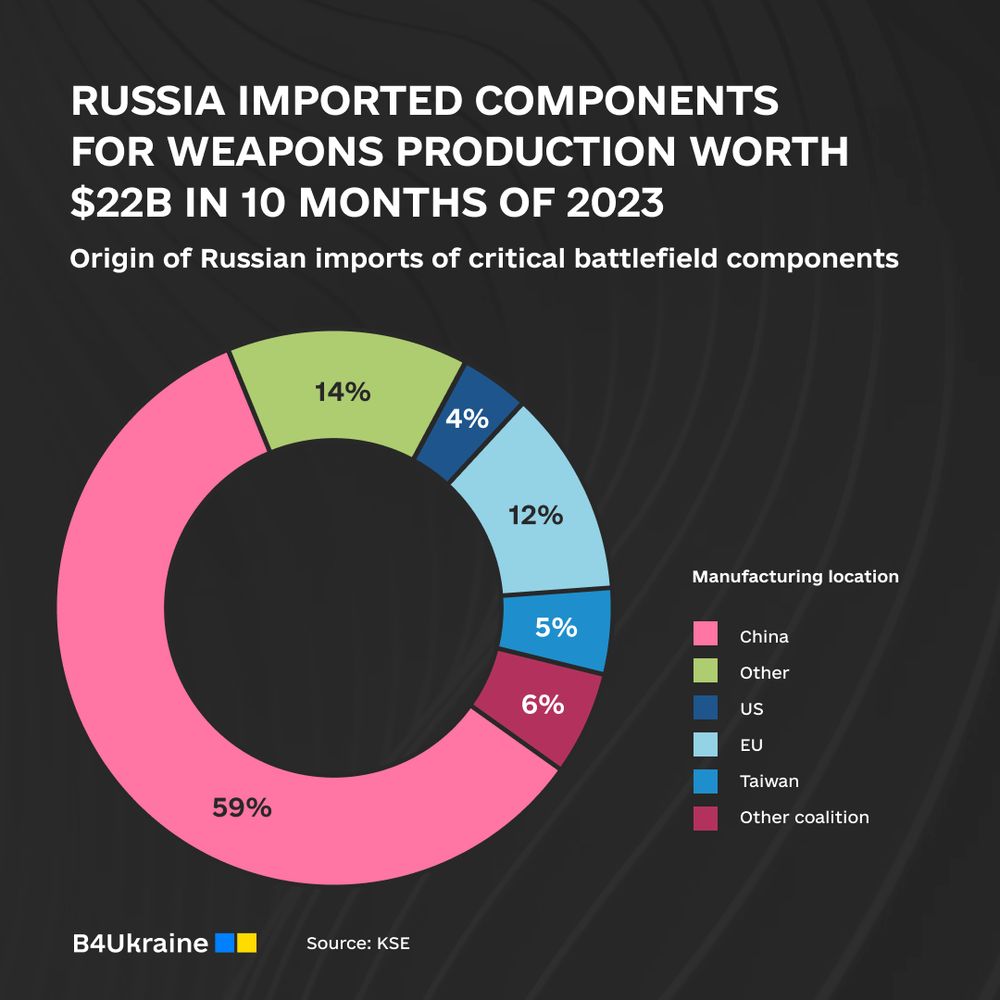

During the same period, Russia imported $8.7 billion in high-priority battlefield goods produced primarily for military use. These parts are currently under US and EU sanctions.

How is this possible?

Most of the goods were produced in countries not part of the US-led export control coalition and Western companies’ outsourced production locations play a critical role by creating sanctions loopholes.

Olena Bilousova, a senior researcher at KSE, told FT that it’s been “a normal business strategy for years for Western technology companies to have manufacturing facilities across Asia, but these factories need to be made to comply with the same strength of export controls as they would at home.”

China’s role remains paramount as the lion’s share of critical technology is funneled to Russia through the country. In the first ten months of last year, 53% of Russian imports of critical components were either sold from or shipped through China, while nearly 60% of Russia’s imports of critical battlefield components were produced in China. Intermediaries in third countries — in particular China, Turkey, the UAE and Hong Kong — are now responsible for the overwhelming share of sales and shipments to Russia. Yet, some of the top sellers are located in the coalition countries, including Intertech Services (Switzerland), Telperien (Lithuania), MR Global (Switzerland), D-Link (Taiwan), and Mykines (United Kingdom).

Most major US technology companies have suspended operations in Russia and don’t sell directly to firms in the country. Russian companies with ties to the military hide the purchases through a complex web of intermediaries and transactions, making them difficult to track.

The study found that since the start of the war, 95% of all parts found in Russian weapons on the battlefield were sourced from producers in coalition countries, with 72% coming from the US-based companies alone. Items from such American giants as Intel, Analog Devices, AMD, Supermicro and Texas Instruments were found in Russian weaponry on the battlefield in Ukraine.

The new findings highlight only a limited effect of sanctions as Russia’s illegal invasion of Ukraine continues to be powered by Western technology from firms based in the United States and Europe. KSE and Yermak-McFaul Group provide recommendations and urge policymakers to address gaps in export controls, including more effective corporate supply chain due diligence and enforcement by governments; better coordination of export controls between countries; and targeting third-country circumvention to ensure Russia doesn’t acquire critical tech.