In November 2023, Russian fossil fuel export revenues dropped to lowest figures since July, despite an upsurge in LNG and pipeline gas, according to the Center for Research on Energy and Clean Air (CREA).

Key things you should know about Russia’s fossil fuel exports in November:

• Russia’s fossil fuel export revenues fell by 7% (EUR 51 mn per day) month-on-month in November 2023, the lowest since July 2023.

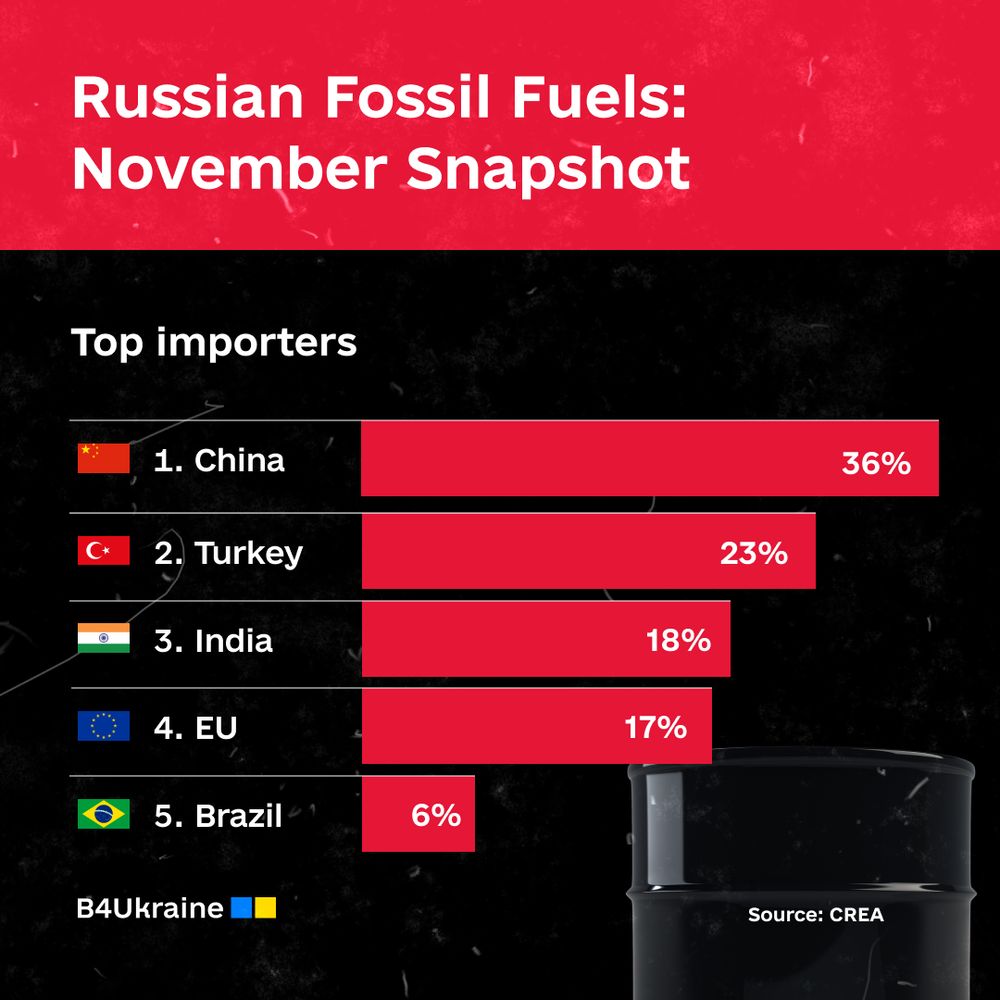

• Storms in the Black Sea basin saw Russia’s seaborne oil export revenues decline by 12% (EUR 55 mn per day).

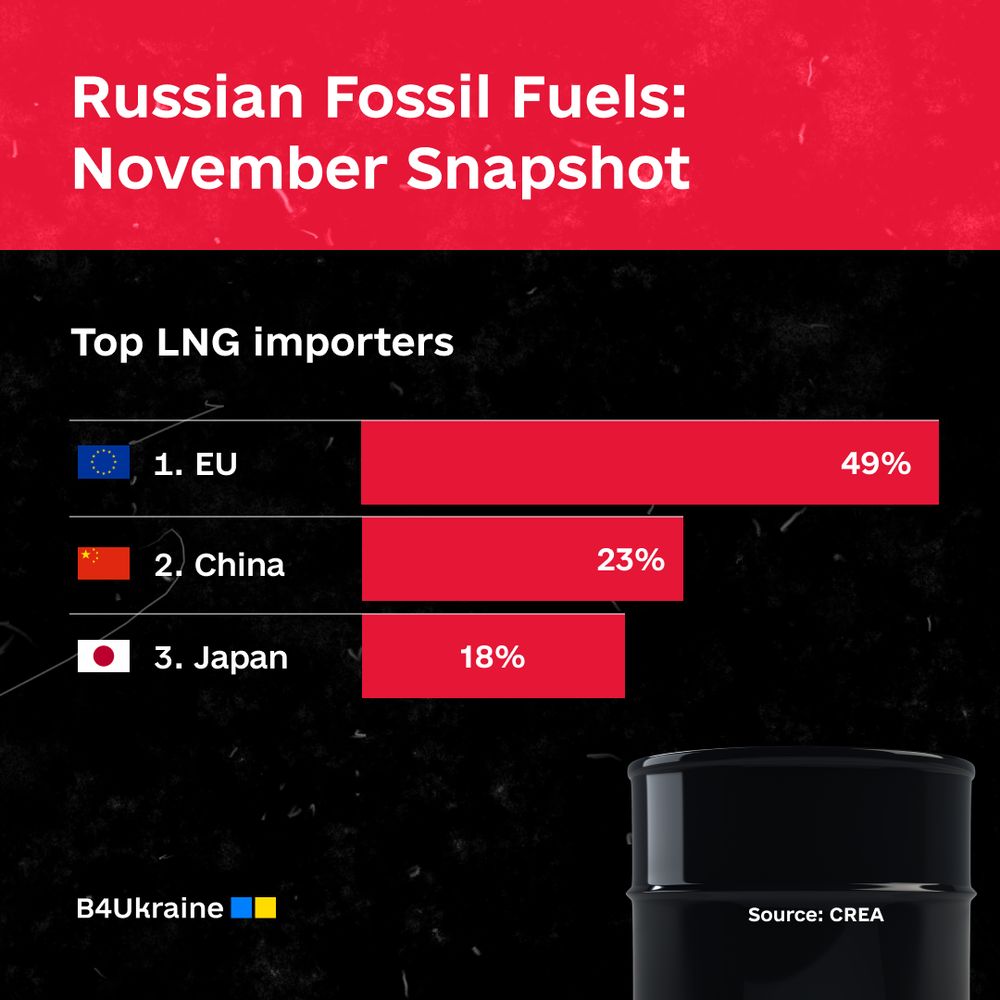

• Revenues from liquefied natural gas (LNG) exports increased by 5% (EUR 2.5 mn per day) month-on-month, while exports from fossil gas via pipeline increased by 25% (18 mn per day).

• France imported LNG worth EUR 316 mn from Russia. Fueled by the start of the heating season, France’s natural gas consumption rose by 79% in November compared to the prior month. This led to an 11% month-on-month increase in LNG imports. Imports from Russia surged by a disproportionate 137%, with 57% of these imports transshipped at the Montoir LNG terminal before reaching final destinations.

• Turkey’s month-on-month imports of pipelined Russian gas increased 68% (EUR 457 mn) in November due to increased gas consumption.

• Enforcing the price cap on Russia’s oil exports would have led to a 14% reduction in oil export revenues (approximately EUR 1.6 bn) in November alone. Since the implementation of sanctions in December 2022 to the end of November 2023, strict adherence to the price cap would have resulted in a 12% reduction in Russia’s revenues, totalling EUR 16.7 bn.

• A price cap of USD 30 per barrel would have slashed Russia’s revenues by EUR 4.9 bn or 41% in November 2023 alone. If this price cap had been established in December 2022 and paired with full enforcement, when the sanctions were originally implemented, Russia’s income would have been reduced by 40% (EUR 56 bn).

• 65% of Russian crude oil was shipped by “shadow” tankers, whereas tankers owned or insured in countries which implement the price cap policy transported 35%. “Shadow” tankers, responsible for transporting oil products, chemicals, and liquefied petroleum gas (LPG), handled 38% of the total volume, while the rest were transported by tankers subject to the price cap policy.

Center for Research on Energy and Clean Air (CREA) is one of B4Ukraine’s partners that regularly publishes valuable analyses on Russia’s fossil fuel sector, including its weekly and monthly snapshots. We are delighted to highlight their findings to bring awareness and clarity to policymakers. Such findings should be used to critically examine the existing issues and devise suitable policies in order to limit Russia’s use of energy as a key source of war financing.