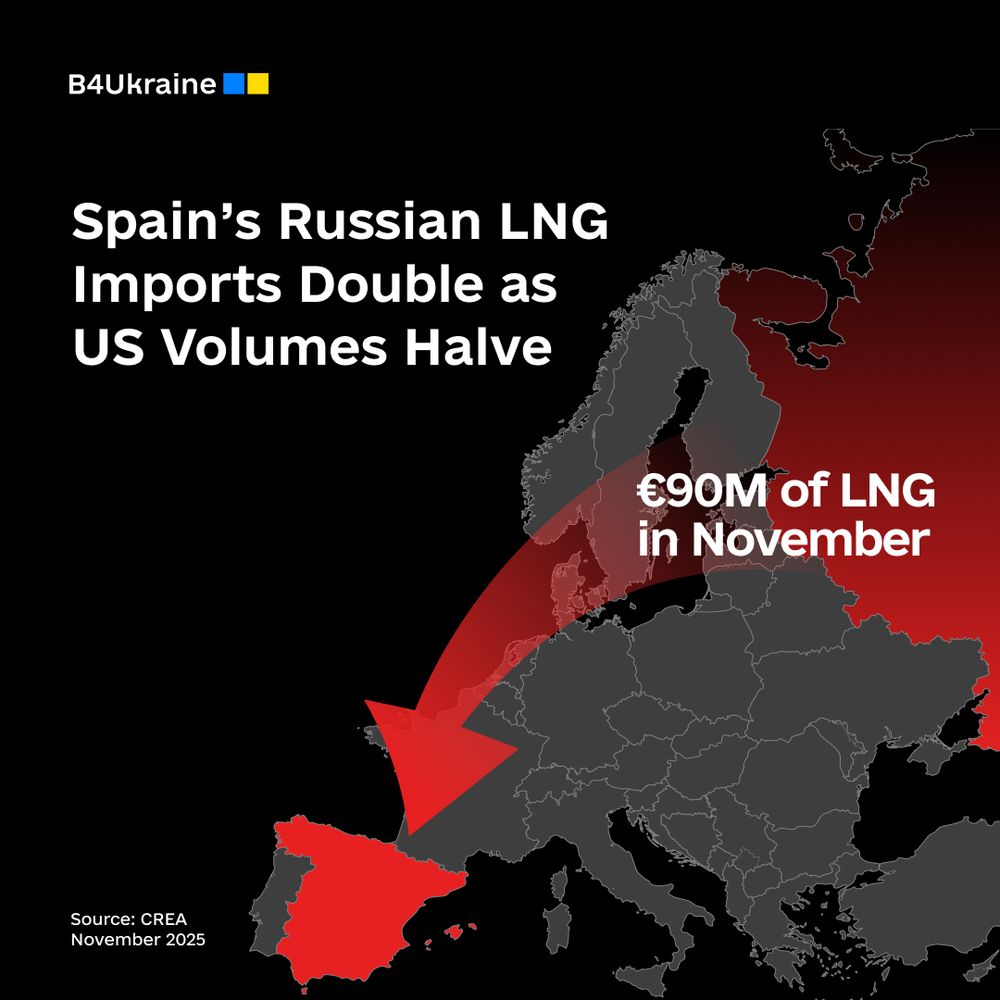

While Spain’s total LNG imports fell by 23% in November, its imports of Russian LNG nearly doubled, and US volumes were cut in half over the same period, according to a monthly analysis by the Center for Research on Energy and Clean Air (CREA).

Spain, the EU’s fifth-largest buyer of Russian fossil fuels, spent €90 million on Russian LNG in November 2025.

The five largest European Union importers of Russian fossil fuels paid Moscow a combined €906 million in November, with natural gas accounting for more than four-fifths of the total.

Natural gas, which is not subject to EU sanctions, made up 82% of the imports and was delivered mainly via pipelines or as liquefied natural gas (LNG). Most of the remaining volumes consisted of crude oil shipped to Hungary and Slovakia through the southern branch of the Druzhba pipeline under EU exemptions.

Hungary was the EU’s largest buyer of Russian fossil fuels in November, importing €312 million worth, the analysis showed. This included €216 million of pipeline gas and €96 million of crude oil.

France ranked second, purchasing €241 million of Russian fossil fuels, all in the form of LNG. Not all of the gas is consumed domestically, however, with part of the LNG entering France via the Dunkerque terminal subsequently delivered to Germany. France’s LNG imports from Russia rose 17% month-on-month, broadly in line with a 15% increase in its total LNG imports.

Belgium was the third-largest importer, buying €150 million of Russian fossil fuels, also entirely as LNG. Belgian imports of Russian LNG fell 5% from October, mirroring a similar decline in overall LNG imports.

Slovakia ranked fourth, with imports totalling €113 million. Crude oil delivered via the Druzhba pipeline accounted for 60% of the total, or €68 million, while pipeline gas made up the remaining €45 million. An exemption allowing Slovak refineries to process Russian crude and re-export oil products to the Czech Republic expired on June 5, 2025, suggesting refined products are now consumed domestically.

Overall, Russia’s monthly fossil fuel export revenues edged down 1% month-on-month in November to about €489 million per day, the lowest level since Moscow launched its full-scale invasion of Ukraine.

Despite the decline, Russia’s fossil fuel exports remain highly concentrated, with China dominating purchases of coal and crude oil, Turkey leading imports of oil products, and the European Union still the largest buyer of Russian LNG and pipeline gas — underlining Moscow’s reliance on a narrow group of key customers.

B4Ukraine calls on the United States, the European Union, the G7 and other democratic allies to move faster to curb Russia’s war revenues by imposing a full embargo on fossil fuel imports.