Russian quarterly fossil fuel revenues have plunged to their lowest since the 2022 Ukraine invasion — with TurkStream gas deliveries down 16% in Q2, according to the Center for Research on Energy and Clean Air (CREA).

Russian fossil fuel revenues in the second quarter of 2025 dropped by 18% year-on-year. This occurred despite an 8% increase in volumes exported in Q2 compared to Q1 of 2025.

The data confirms that Moscow is struggling to reroute gas after the end of transit through Ukraine, while European buyers race to diversify.

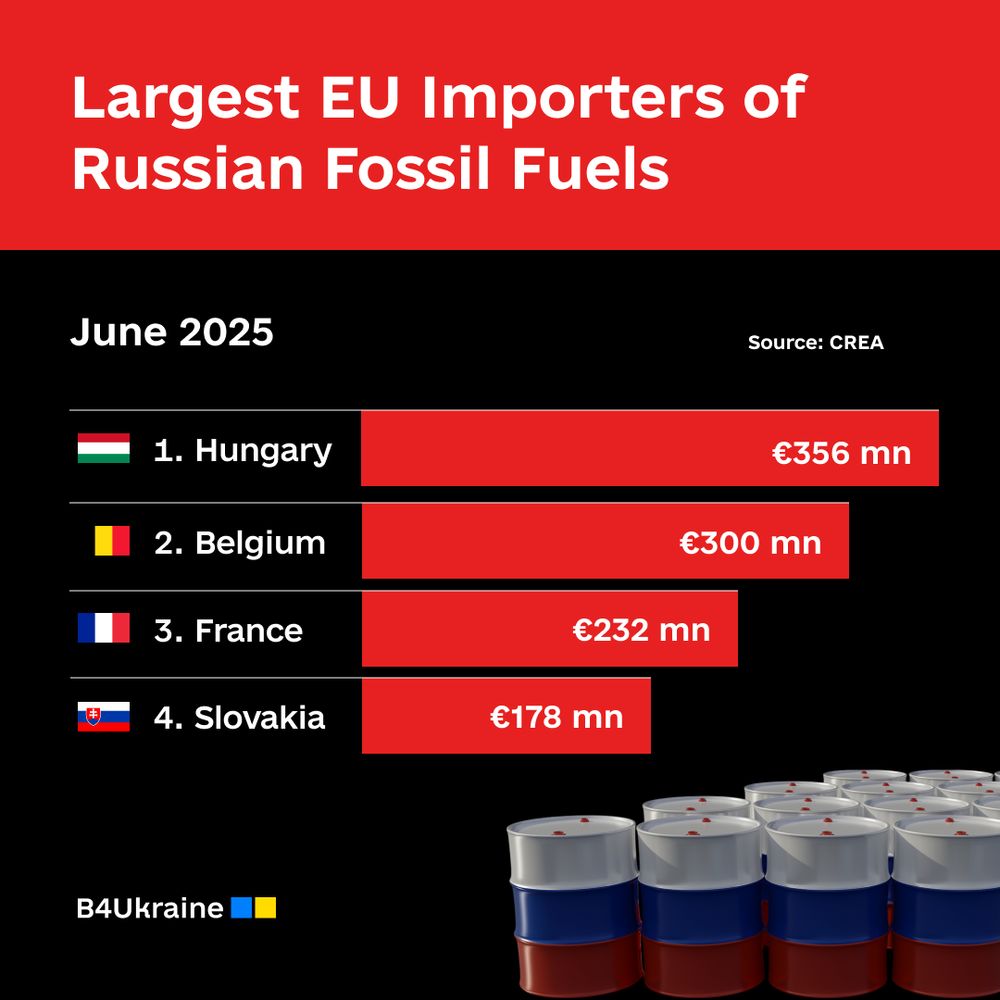

In June 2025, the five largest EU importers of Russian fossil fuels paid a total of EUR 1.2 bn. The EU does not sanction natural gas, which accounts for over 72% of these imports and is mainly delivered by pipeline or as liquefied gas. The rest was mostly crude oil, which continues to flow to Hungary and Slovakia via the southern branch of the Druzhba pipeline under an EU exemption.

Hungary was the largest importer, purchasing EUR 356 mn of Russian fossil fuels in June. These included crude oil (EUR 165 mn) and gas via pipeline (EUR 191 mn).

Belgium was the second-largest importer of Russian fossil fuels in June, with their purchases totaling EUR 300 mn. The entirety of their imports consisted of Russian LNG. Belgium’s imports of LNG from Russia rose by 12% month-on-month, in line with a 12% increase in total LNG imports in June.

France, the third-largest buyer within the EU, imported Russian fossil fuels worth EUR 232 mn, all of which was LNG. However, the fact that this gas is imported via France does not necessarily mean it is consumed there. A recent study indicates that some Russian LNG entering France through the Dunkerque terminal is delivered to Germany.

Slovakia was the fourth-largest importer of Russian fossil fuels within the EU. Almost 81% of Slovakia’s imports consisted of crude oil via the Druzhba, valued at EUR 178 mn. The derogation allowing Russian crude oil to be refined into oil products and re-exported to Czechia has now expired as of June 5th.

And there’s more bad news: Over half of Russia’s seaborne oil exports in June were shipped on G7+ tankers, up from 36% in January to 56%.

We can and must do more to choke off Kremlin war funding:

• Lower the oil price cap

• Crack down on sanctions evasion

• Ban unsanctioned fossil fuels like LNG and pipeline gas