According to an analysis by the Centre for Research on Energy and Clean Air (CREA), Russia’s fossil fuel export revenues fell by 6% in April 2025 compared to the previous month.

Nearly half (47%) of Russia’s oil exports were transported on tankers owned or insured by G7+ countries in April, marking a 4 percentage point increase from March.

Top Importers and Regional Highlights

China, India, Turkey, the European Union, and Brazil remained the leading importers of Russian fossil fuels last month. Notably, China increased its imports of seaborne Russian crude by 8%, taking advantage of lower global oil prices to build refinery inventories and conduct ship-to-ship transfers.

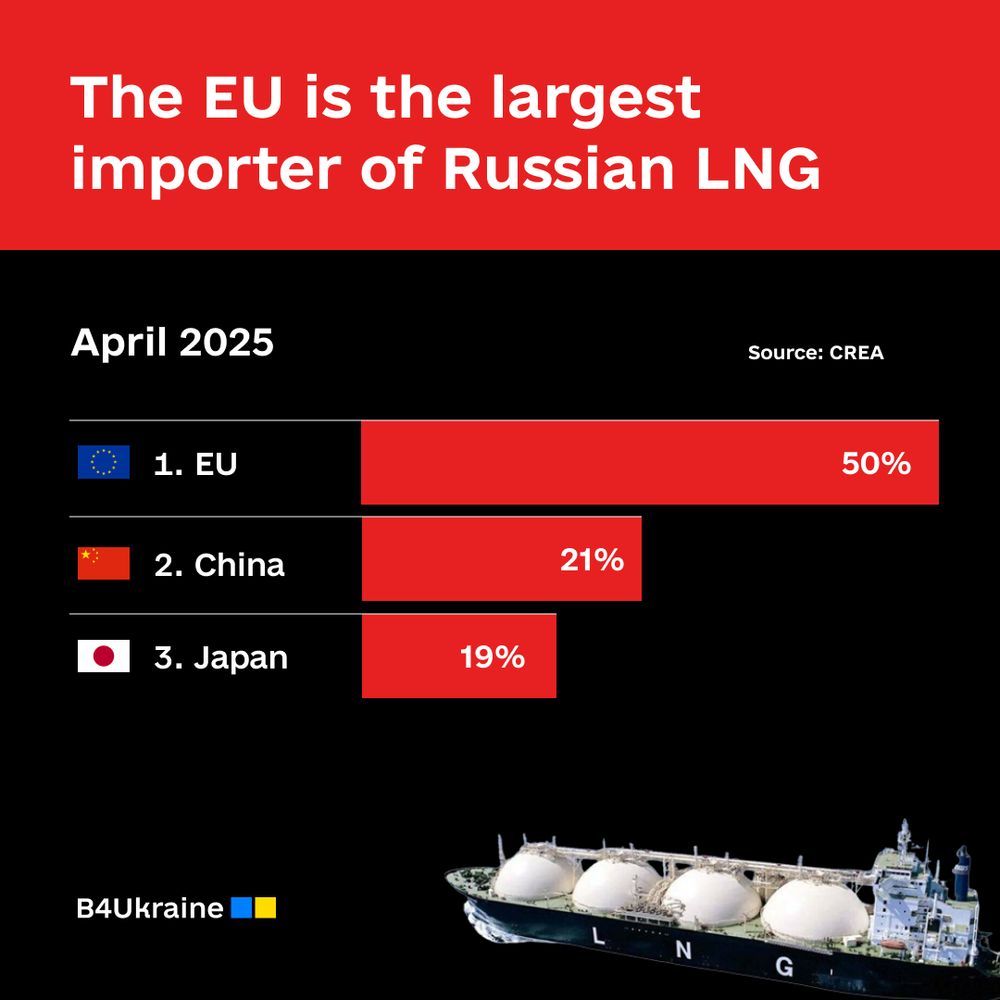

Within the EU, the top importers of Russian fossil fuels were Hungary, France, Slovakia, Belgium, and Spain. While the EU maintains sanctions on Russian oil, natural gas imports — constituting over 70% of these flows — are not sanctioned, allowing continued supply. The EU was the top buyer of Russian gas in April, purchasing 50% of its LNG and 37% of its pipeline gas.

Hungary, Slovakia, and Czechia continue to receive crude oil shipments under an EU exemption. The price discount for Urals-grade crude oil narrowed by 20% month-on-month to $5.5 per barrel below Brent crude, while the discount for the Sokol blend tightened by 14% to $2.7 per barrel.

Shipping and Sanctions Enforcement

In April, Russia exported 23.5 million tonnes of oil by sea, a 7% decrease from March. The share of “shadow” tankers—vessels that obscure their ownership or identity — fell from 65% to 53%.

CREA emphasizes that ongoing monitoring, enforcement, and stronger penalties remain essential to curb Russia’s fossil fuel revenues. They also highlight that had the international community set a lower oil price cap of $30 per barrel in December 2022, Russia’s earnings would have been slashed by approximately €138 billion (40%) through April 2025. In April alone, this lower cap could have cut Russian revenues by €4.13 billion (38%).

Center for Research on Energy and Clean Air (CREA) is one of B4Ukraine’s partners that regularly publishes valuable analyses on Russia’s fossil fuel sector. We are delighted to highlight their findings to bring awareness and clarity to policymakers. Such findings should be used to critically examine the existing issues and devise suitable policies in order to limit Russia’s use of energy as a key source of war financing.