The Price Cap Coalition should take back the initiative from the Kremlin and lower the price cap closer to Russia’s production costs estimated at around $15 per barrel.

One of the Kremlin’s most reliable sources of revenue comes from oil and gas exports. In 2021, cash from this stream made up 45% of the Russian federal budget. In an attempt to limit the extent to which Russia can continue deriving revenue from its energy exports, western countries adopted sanctions and restrictive measures, including the oil price cap system.

Price cap’s failure

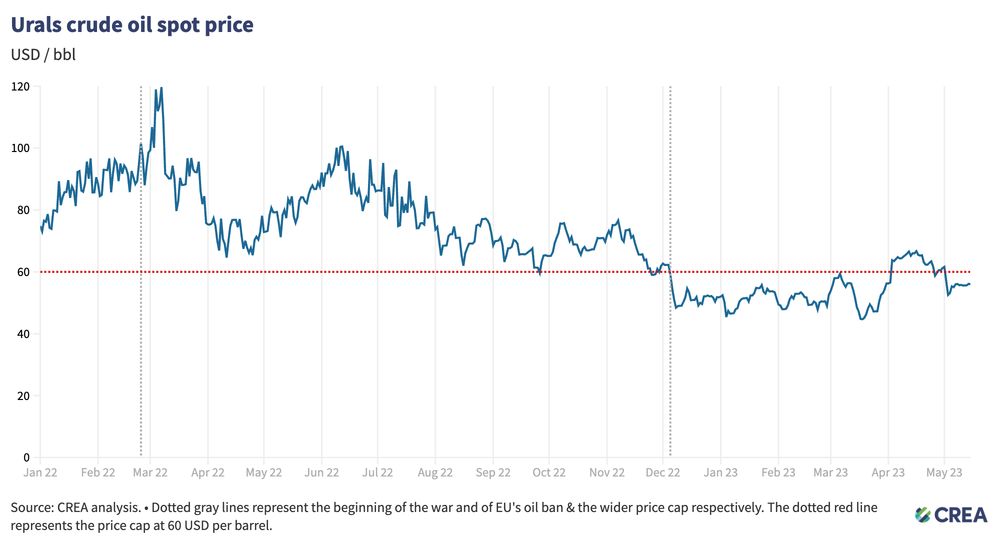

In December 2022, the G7, EU, and Australia agreed on the $60 per barrel price cap for Russian oil in addition to the EU’s crude oil import ban designed to limit Russia’s ability to conduct its illegal invasion and occupation of Ukraine.

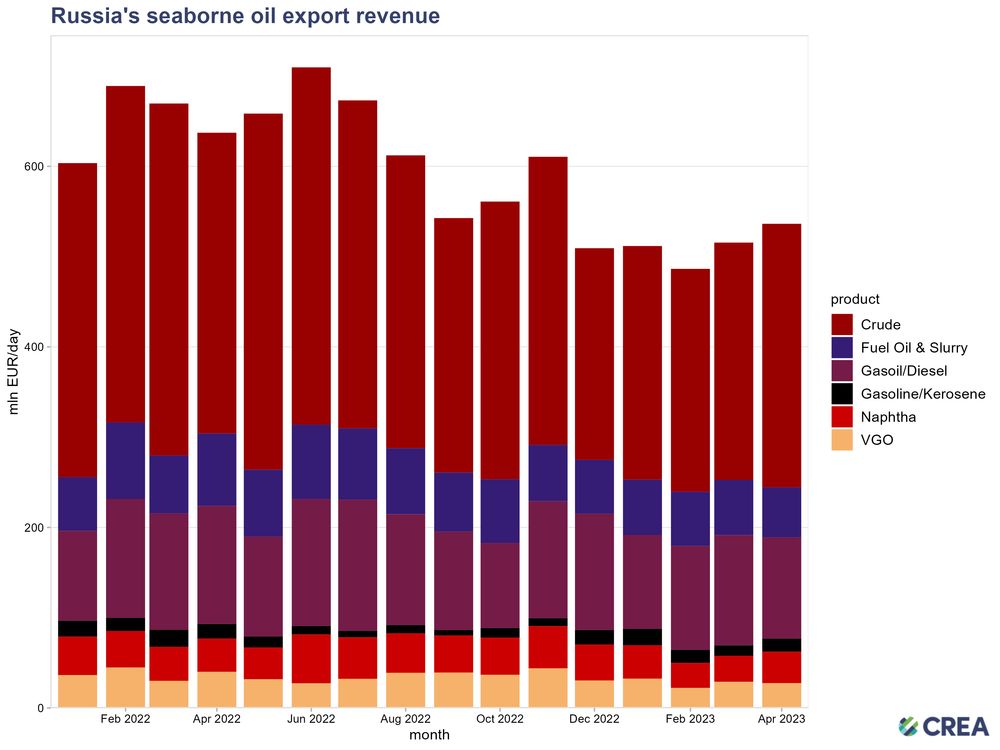

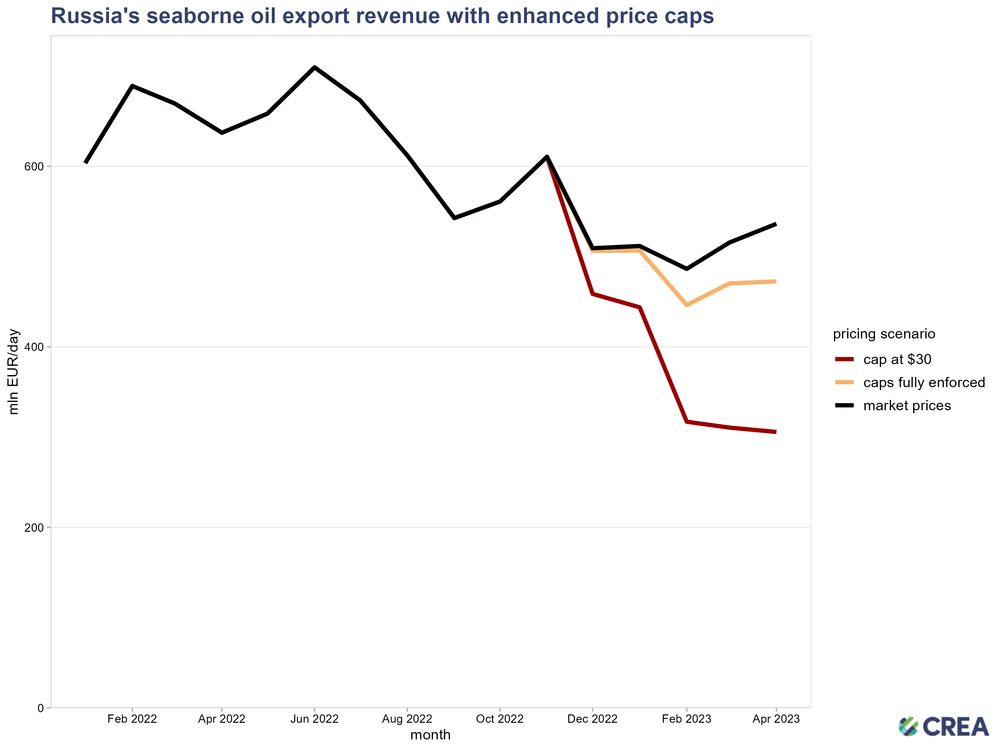

The latest analysis from the B4Ukraine Coalition member, the Centre for Research in Energy and Clean Air (CREA), shows that despite the price cap policy having a solid start in December last year, Russia’s oil revenues have rebounded in March–April 2023 from the levels reached in January-February of the same year.

CREA’s analysis highlights that since December 2022 Russia has earned an estimated €58 billion ($63 billion) in export revenue from seaborne oil, which, according to B4Ukraine analysis, covers 75% of Russia’s project defense budget for 2023. Despite all of this, at the most recent G7 Summit in Japan, the leaders of the industrialized countries unanimously proclaimed that the price cap is working as “Russia’s revenues are down.”

EU tankers (not) for Kremlin’s oil

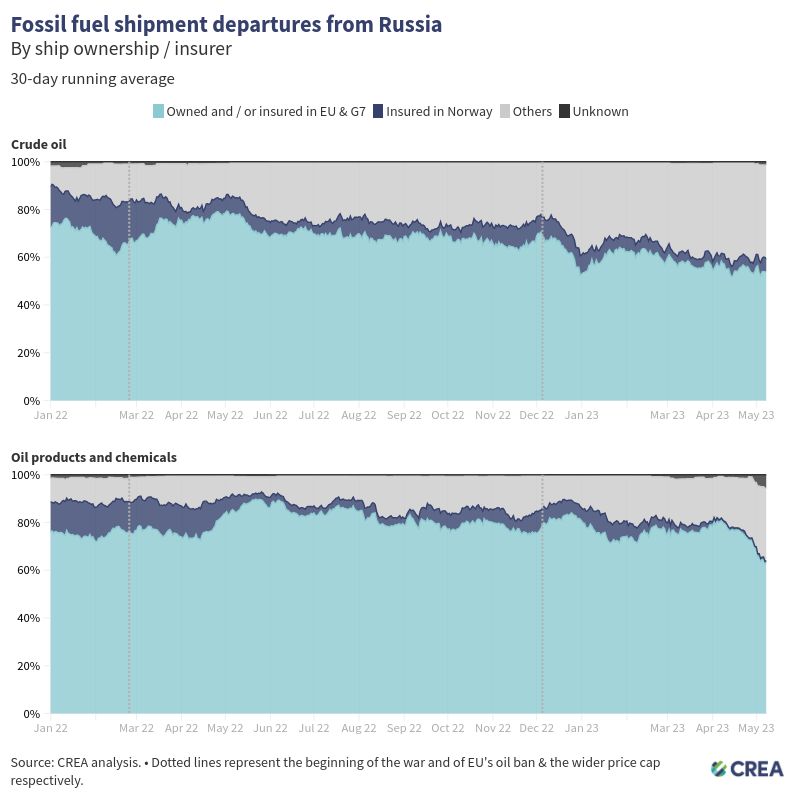

The price cap coalition holds every advantage, as Russia continues to rely on European-owned and insured tankers for more than half (54%) of its oil exports.

Even as the reported price of Urals crude oil rose above the price cap in April, European tankers continued to transport Russian oil, indicating that enforcement is not working. It has also been apparent for months that the enforcement of the price cap does not function in the Pacific trade from Russia’s Far Eastern ports to China.

In light of this information, the EU and G7 should consider banning tankers that violate price caps from entering the Price Cap Coalition countries’ ports and territorial waters, CREA suggests. Additionally, CREA calls for the establishment of a dedicated Russian oil sanctions monitoring and enforcement authority in order to conduct regular monthly and extraordinary audits.

Reform or let go

CREA’s analysis shows that Russia’s revenue could have been slashed by €22 billion (37%) by setting the price cap for crude oil at $30 per barrel and revising the caps for oil products accordingly. Yet, the Price Cap Coalition has failed in its commitment to review the price cap every two months to ensure that it stays lower than the average market price.

“Unless the Price Cap Coalition takes action to lower the price cap level and plug the enforcement gaps, changes to Russia’s oil taxation structure will force the price of Russian crude oil closer to international benchmarks, leading to further recovery of Russia’s oil revenue and wholesale failure of the price cap system,” said CREA’s Energy Analyst Isaac Levi.

The Price Cap Coalition should take back the initiative from Putin and lower the cap closer to Russia’s production costs estimated at around $15 per barrel. Lowering the price cap would reduce inflationary pressure on the global price of oil, a key objective for policymakers, as well as limit Moscow’s ability to fund the war against Ukraine. However, if such measures were to fail, the EU needs to fully abandon the price cap arrangement, replacing it with a full services ban so that European-owned ships can no longer participate in replenishing Russia’s war coffers.