Despite a 2% month-on-month decline, Russia’s fossil fuel export revenues for October were the second-highest for 2023, with a notable rise in seaborne and pipeline crude, according to the Center for Research on Energy and Clean Air (CREA).

Compared to September, Russia’s monthly export revenue from fossil fuels marginally declined in October by EUR 16 mn per day (-2%).

Seaborne oil products saw the most significant decline — amounting to EUR 19 mn per day (-7%) — primarily due to restrictions on the export of these products.

Seaborne and pipeline crude oil, on the other hand, rose by EUR 7 mn per day (+3%) and by EUR 5 mn per day (+4%), respectively.

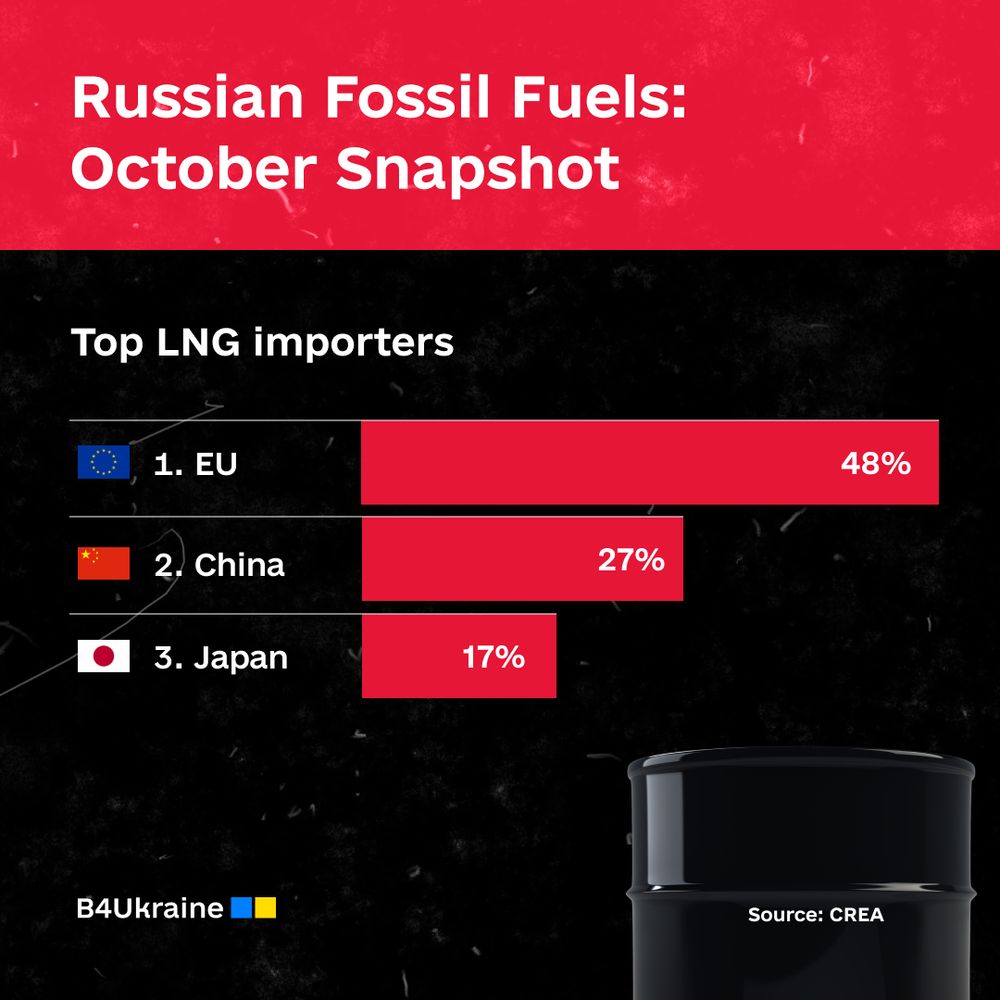

The 10% (4mn per day) increase in monthly revenues of LNG can be attributed to a growth in exports to Asia (8%) and Europe (27%).

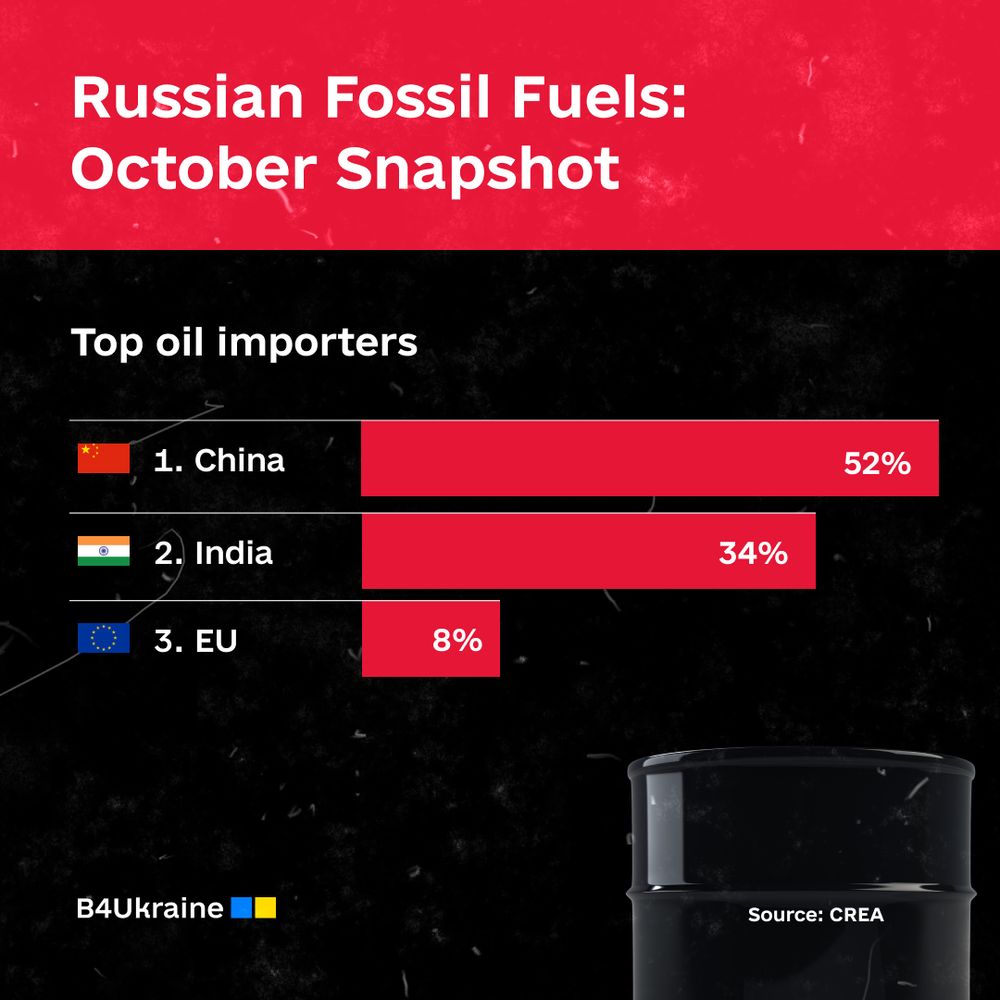

China was the largest importer of Russian fossil fuels, followed by India, Turkey, the EU, and Singapore.

Month-on-month revenue from Russian crude oil exports to China saw a marginal 4% increase, with a notable portion of the imports from the Eastern Siberia–Pacific Ocean (ESPO) oil blend.

Russian monthly revenues from seaborne crude oil to India increased by 17% — around EUR 500 mn.

In October, 48% of Russian crude oil and oil products were transported by tankers subject to the oil price cap policy. The rest (52%) were shipped by “shadow” tankers, which are not subject to the price cap policy.

Setting the cap for crude oil at USD 30 per barrel could have slashed Russian revenues by 52% (EUR 7.82 bn) in October alone, CREA said. “If this cap had been set since the sanctions against Russian oil were imposed in December 2022, Russia’s oil export revenues could have been slashed by nearly half — EUR 59 bn (-49%). Reducing the price cap would be deflationary and force Russia to produce more oil to compensate for the drop in price.”