Every year international consulting company Kantar names the top 100 most valuable global brands. These are the strong brands that are considered to deliver superior shareholder value, be more resilient in times of crisis, and recover more quickly. In 2022, the Kantar BrandZ Global Top 100 Most Valuable Brands grew by 23% year-on-year to a total value of nearly $8.7 trillion. But will they stand the test of the main ethical challenge business is facing this year — Russia’s unjust and horrific war in Ukraine?

Only 22 out of the 100 most valuable global brands haven’t been working in or with Russia at the time when it waged a full-scale war against Ukraine on February 24, 2022. The rest of the 78 companies faced the dilemma — leave the aggressor country for good, reduce some operations in the hope to buy some time, or ignore the world’s biggest humanitarian disaster since WWII and simply continue doing business as usual in Russia.

The road the companies choose to take will define their relations with the customers for a long time ahead as the horrors of the war in Ukraine have drastically changed what customers expect from businesses they buy from. According to the 2022 Edelman Trust Barometer Special Report: The Geopolitical Business published in May 2022, now 6 in 10 people want businesses to punish countries that violate human rights and international law. Moreover, 5 in 10 people have already altered their behavior toward a brand or company (started or stopped buying its goods and services and encouraged others to stop buying a brand) based on how it has responded to Russia’s invasion of Ukraine.

This unprecedented demand for businesses to take a stand in response to the war in Ukraine is even more challenging for the top 100 most valuable global brands that have worked long and hard to get people to love them by marketing commitments to things that matter to their customers: environmental sustainability, promoting equality and inclusion, fighting social injustice, poverty, and hunger.

Over four months into Russia’s war in Ukraine, we can already see whether the brands’ commitments have been genuine and reputation integrity remains intact, and, thus, whether they will be able to keep people’s love and record-high brand value in the future.

How many of the 78 most valued global brands remain in Russia?

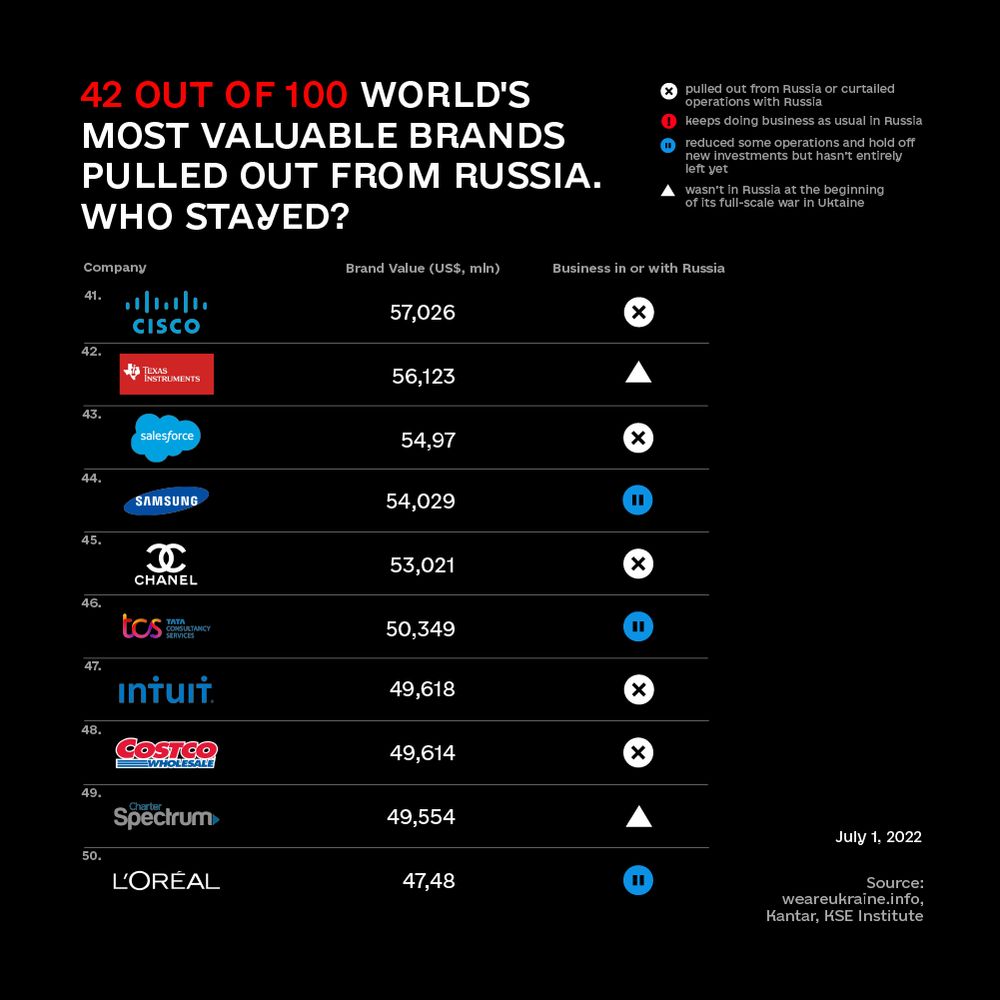

Since the full-scale invasion in Ukraine, out of 78 most valuable global brands, 42 have already pulled out of Russia. These include Starbucks, which decided to exit and no longer have a brand presence in the Russian market; Uber, which divested from its partnership with Yandex; Netflix, which suspended service in Russia; and Airbnb, which blocks bookings and accepting guests in Russia.

Yet, 26 brands are still trying to buy time by reducing or freezing some operations and delaying making a decision. For example, social media platforms (except TikTok) mostly haven’t banned Russian users but put restrictions on monetization or promotion functions. Tech giants have stopped selling their products in Russia, but still conduct some other business operations in the country. Nvidia has its Russian R&D office working. Samsung has its IT school and social media running, which highlights the company’s continuous marketing activity in the country. Even the world’s most valuable brand Apple hasn’t disabled Apple TV, Apple Music, iTunes, and App Store in Russia.

Disney has announced it will pause the release of films in Russia but also stated it will take time to cut down other business operations and, more importantly, the company keeps its Russian employees. The same goes for L’Oréal — keeping their offices running and 2500 Russians employed. Beauty giant also keeps quiet on the future of its Russian factory and opens beauty schools.

Moreover, 10 of the world’s most valuable brands continue doing business as usual in Russia despite all the war crimes Russians conduct in Ukraine every day. No surprise, most of these brands are Chinese. Chinese internet giant Tencent Holdings still has a stake in VK (formerly known as Mail.ru Group), which operates the three largest and most popular Russian social networking sites VK, Odnoklassniki, and Moi Mir. AliExpress Russia, in which e-commerce giant Alibaba Group Holding holds about a 48% stake, has laid off about 40% of employees in Russia since the beginning of the full-scale war in Ukraine, but, nevertheless, Chinese holding hasn’t pulled out yet.

What awaits those who stay?

War brings harm in several ways. There is direct damage with the destruction of Ukrainian cities and the killing of tens of thousands of civilians. And then there are consequences to the world, mainly through disruption of the movement towards a sustainable and inclusive future.

According to the UN, Russia’s war in Ukraine risks tipping up to 1.7 billion people — over one-fifth of humanity — into poverty, destitution, and hunger. Ending world hunger is now even less achievable than it was since Russia is weaponizing food to artificially drive world food prices up and, thus, to be able to blackmail the rest of the world the same way as it does with energy supplies. At the same time, the green transition is being postponed while the world struggles to urgently cut its dependency on Russian oil and gas, and more and more efforts are put into developing already familiar energy sources like coal, gas, and nuclear power, than into developing renewable and safer sources. In addition, with the world war threat looming over the globe, countries are now more inclined to increase military spending while taking money from sustainability projects.

Those companies which keep operating in Russia literally fund this disruption by paying taxes to the Russian budget, and the markets are willing to make them pay for that. The study conducted by the Yale School of Management shows that markets benefit those who opt to leave Russia, granting more gains for stocks, as well as improved corporate standing when it comes to debt, credit spreads, and related credit default swap pricing. It can be easily explained by the fact that investors expect such companies to do fine eventually. While the companies quick enough to pull out from Russia during the first months of the war have suffered a shock of losing market and revenue, they will probably regain what was lost by expanding into new markets and increasing their presence in existing ones thanks to meeting their customers’ expectations. However, the companies that chose to stay in Russia had an average fall in stock prices of 12,54%, according to the Yale SOM.

As the performance of the world’s 100 most valuable brands’ stock during the first four months of the war in Ukraine shows: these brands benefit from such extraordinary customer loyalty and investor respect that for them markets’ response is not as immediate as it has been for hundreds of more diverse and less valuable companies analyzed by the Yale SOM. But even if this response is more stretched in time, it is still very likely to happen eventually for many reasons.

Such brands have already suffered some reputation losses because of supporting the aggressor state with money and lack of condemnation. But there is more to come. Even though they have managed to save their share of the local market for now, in the long run, the Russian economy, hit by sanctions, will suffer more and more, taking from consumer purchasing power, shrinking the market size, and lowering the revenue these companies can get in Russia.

Moreover, time is of the essence for brands that have chosen to keep doing business as usual in Russia so far. The more other companies leave Russia, the more eyes will be focused on those who stay. It means more public pressure and more questions about the integrity of the remaining brands’ reputation, especially those claiming to be pro-sustainable and continuing to sponsor disruptive and unjust war.

Increasing attention and public pressure are likely to push the remaining brands to leave Russia as well. But doing this step later rather than sooner will prolong the blow to their stocks on top of revenue losses caused by reputation damage in Europe and the United States and the shrinking of the Russian market. And, since brand value depends on the total financial value of the company, once the companies see their stock prices fall, the brands’ value will follow.

So, the question is: will we ever see the brands operating in Russia on the 2023 Kantar BrandZ Global Top 100 Most Valuable Brands list if they won’t be smart enough to pull out from Russia as soon as possible?