International firms still operating in Russia paid at least $20 billion in taxes there in 2024 alone, bringing the total since the full-scale invasion to more than $60 billion.

B4Ukraine — an international coalition of nearly 100 civil society organisations — calls on the G7 and allied countries to urgently tackle the role their businesses play in Russia today and how it impacts Ukraine’s population and the war’s outcome.

- The majority (55% or 2,326) of international companies with ties to Russia at the start of 2022 continue to do business within the aggressor state, contributing to the war through the taxes they pay, the supply chains they support and the technology and training they provide.

- 1,377 or 45% have officially declared that they are completely shutting down, or have announced they are temporarily reducing operations, but haven’t yet fully exited.

- Only 503 (12%) global firms have completely pulled out of Russia by selling or liquidating their business.

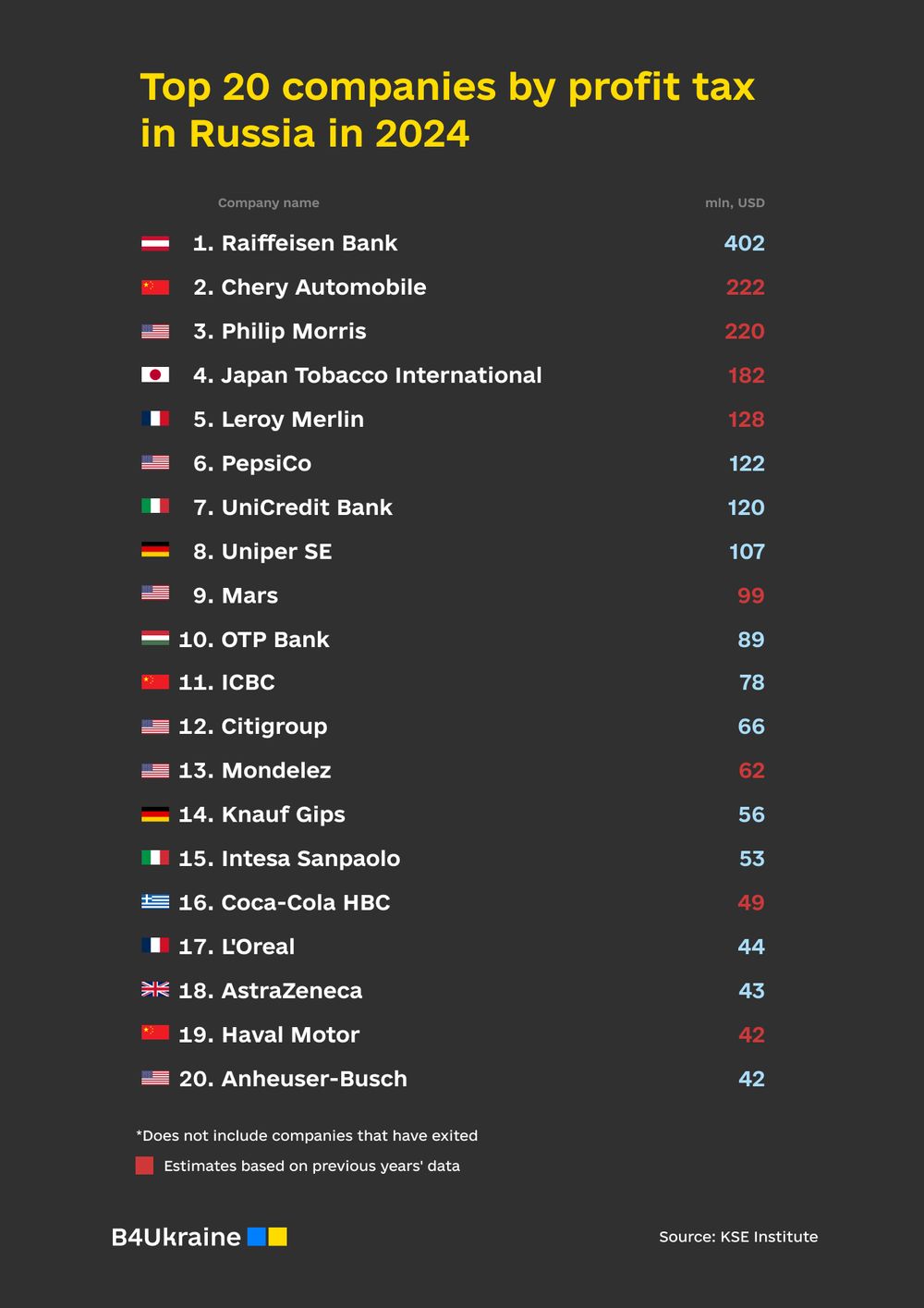

Based on data from the Kyiv School of Economics, the analysis titled ‘Corporate Complicity: How Global Firms Bankrolled Russia’s War Chest in 2024’ found that 17 of the 20 largest profit taxpayers in Russia are companies headquartered in G7 and EU countries, undermining their own governments’ efforts to curb the Kremlin’s revenues and support Ukraine’s independence.

In 2024, American firms reported $38 billion in revenue and paid $1.2 billion in profit tax, while German companies generated $19 billion in revenue and contributed $594 million in taxes. Altogether, businesses from EU member states earned $93.5 billion and handed over approximately $2.64 billion to the Kremlin. For every thirteen dollars of EU aid for Ukraine, their companies may still pay one dollar in taxes to Russia. “It is shocking that while Russia bombs homes, schools, and hospitals in Ukraine, Western companies keep paying taxes to Putin as if nothing were happening,” said Nezir Sinani, Executive Director of B4Ukraine. “These payments directly contribute to Russia’s atrocities: in 2024 alone, the taxes paid by foreign firms could have financed more than one million Russian soldiers. This must end now.”

The financial sector accounted for the largest tax contributions by foreign firms. In 2024, it paid $1.28 billion in profit tax, confirming the trend of recent years. Austria’s Raiffeisen Bank International, Italy’s UniCredit, and Hungary’s OTP Bank remain key players. The fast-moving consumer goods (FMCG) sector generated $32.7 billion in revenue and $670 million in profit tax, with major contributors including Mars, Nestlé, Procter & Gamble, Leroy Merlin, and Metro. The automotive industry produced $30.4 billion in revenue and $571 million in taxes, as Chinese manufacturers quickly moved to fill the gap left by Western brands. Consumer sectors (food & beverage, alcohol & tobacco, FMCG) together generated $71.4 billion and paid $1.67 billion in taxes, overtaking even the financial sector.

Many corporations have failed to deliver on their public promises to exit or scale back in Russia. In 2024, PepsiCo opened a new plant in Russia; Mondelez removed from its website the commitment to make its Russian operations “stand-alone”; Raiffeisen Bank International remained the largest foreign bank taxpayer; Mars invested in new warehouse facilities in Moscow; Coca-Cola HBC continued to profit through the rebranded products.

Increasing numbers of foreign firms have stopped publishing their financial reports, a trend particularly noticeable among large corporations. Of the 100 largest foreign companies operating in Russia in 2021, 86 disclosed their financials in 2023. This number has halved in 2024 to just 43.

A full withdrawal from Russia is not only a moral imperative but also a strategic necessity for foreign companies, according to Andrii Onopriienko, Deputy Director for Development at KSE and Head of the LeaveRussia Project. “In an environment of deepening lawlessness, the Russian government effectively controls the assets of foreign businesses that remain. The financial, legal, and reputational risks — from escalating taxes and pressure to support the war effort to the constant threat of expropriation — far outweigh any short-term commercial gains,” he said.

B4Ukraine calls on companies to ensure a swift and responsible exit from the Russian market and to contribute to Ukraine’s recovery and reconstruction. The coalition also urges G7 and EU governments to incentivize and reward responsible exits, while introducing deterrents — including financial penalties, restrictions on contracts, and exclusion from public procurement — for firms that continue doing business in Russia.