Sixteen months after the full-scale invasion of Ukraine and over 95 thousand recorded war crimes, western household names are still contributing billions of tax dollars to the Kremlin and further enabling Russia’s war of aggression, according to a new report from B4UKraine and the Kyiv School of Economics (KSE):

- 56% of companies monitored by KSE are still committed to staying in Russia.

- Almost a quarter of all profit tax paid in 2022 was paid by companies headquartered in G7 nations.

- US companies generated more revenue and paid more in profit taxes to the Russian government than any other country.

- Germany, Switzerland, Japan and the UK were also significant contributors.

- Governments of G7 countries, EU and Switzerland must look beyond sanctions compliance to clarify the expected standard of corporate conduct. B4Ukraine calls on the Biden Administration to lead the way by issuing a business advisory.

According to data from the Kyiv School of Economics (KSE), out of 1,387 Western companies with Russian subsidiaries at the start of the full-scale invasion, only 241 (17%) have completely exited Russia. The majority of companies (56%) monitored by the KSE are committed to doing business in Russia.

As the G7 moves to further restrict Russia’s access to critical technology and sources of finance for waging war, international companies from G7 countries risk undermining their own government’s foreign policies by remaining in Russia. They also expose themselves and their shareholders to an ever-expanding galaxy of material, reputational and legal risks.

- Russian taxes help fund the war

In 2022, global corporations — including those that have exited since the war — made over $213.9 billion in revenues through their local Russian businesses and paid $3.5 billion in profit taxes. This is only the tip of the iceberg and likely a substantial underestimate of the total tax bill.*

- How much are companies from each country paying in profit tax to the Russian state?

While some US companies have led the way in making a responsible and swift exit from Russia, American firms have collected the largest total revenues in Russia and are the biggest contributors to the Kremlin’s coffers through taxes on profits. 44% of US companies that had a presence at the start of the full-scale invasion remain in Russia. This is substantially lower than for countries like China, Germany or Japan where the majority of companies have chosen to remain. However, the US-based firms were by far the largest profit tax contributor to the Russian state paying $712 million in total, with Germany following suit. Its companies paid $402 million in profit tax to Russia in 2022.

The EU, which has been tough on Russia and a major donor to Ukraine, faces a similar problem when it comes to firms headquartered in its member states. Companies headquartered in current EU member states, earned $75.2 billion in 2022 — significantly more than US-registered firms — and paid $594 million in profit taxes.

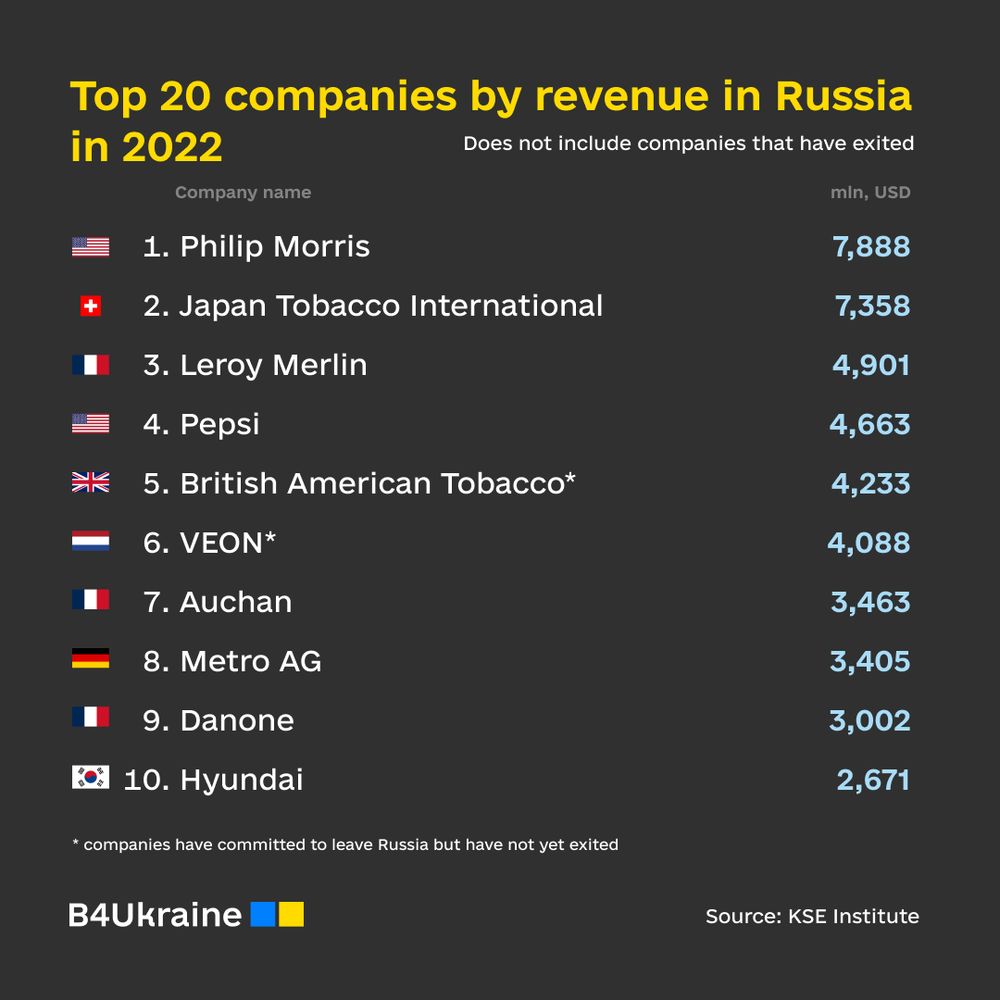

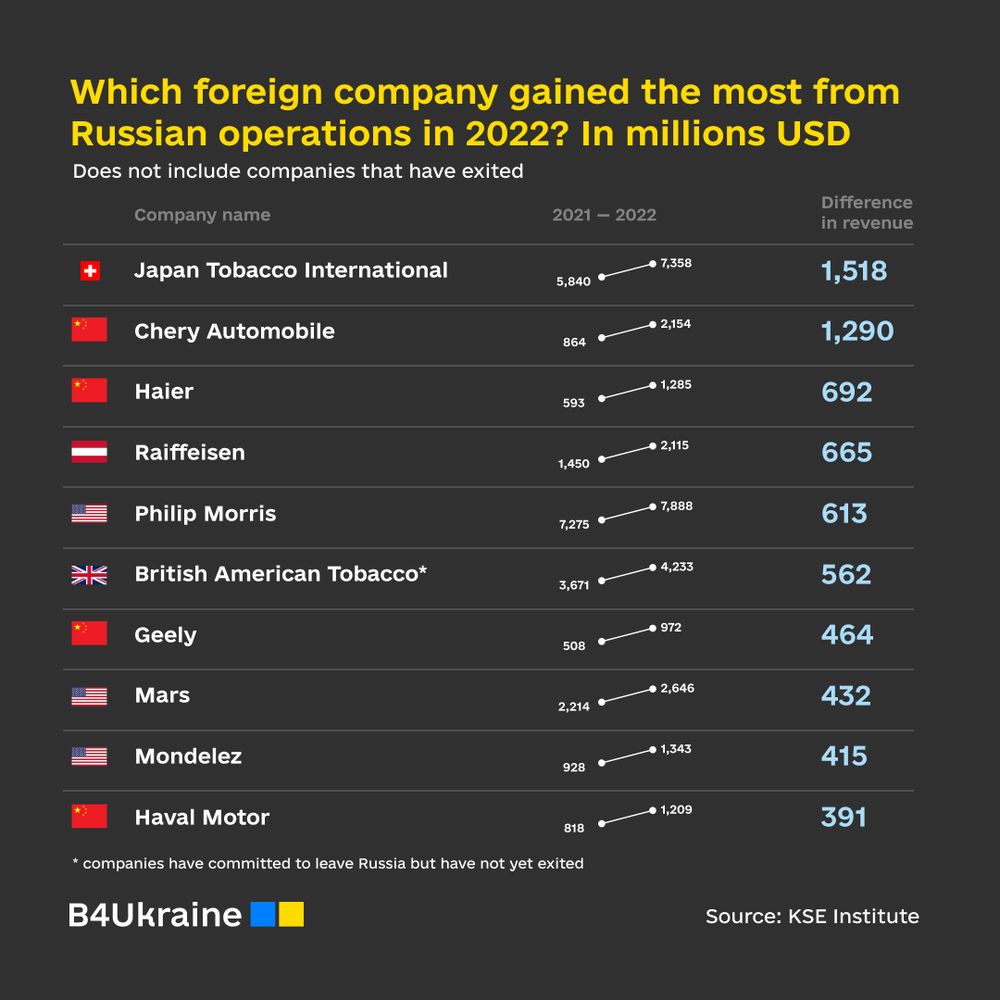

- Doubling down on Russian revenues

Despite Russia becoming a precarious place for global brands to do business, a number have chosen to double down on their Russian activities. For some, this has been a lucrative gamble. While the appearance of Japan International Tobacco or Phillip Morris on the list of most prominent gainers in 2022 is not at all surprising - given the size of the Russian alcohol & tobacco market - some other corporate names on the list raise real eyebrows. Austria’s embattled Raiffeisen Bank International (RBI) and the American snacking giant Mondelez International are among those foreign firms that managed to benefit the most from their Russia operations last year. Both companies have been designated “international sponsors of war” by Ukraine’s National Agency on Corruption Prevention.

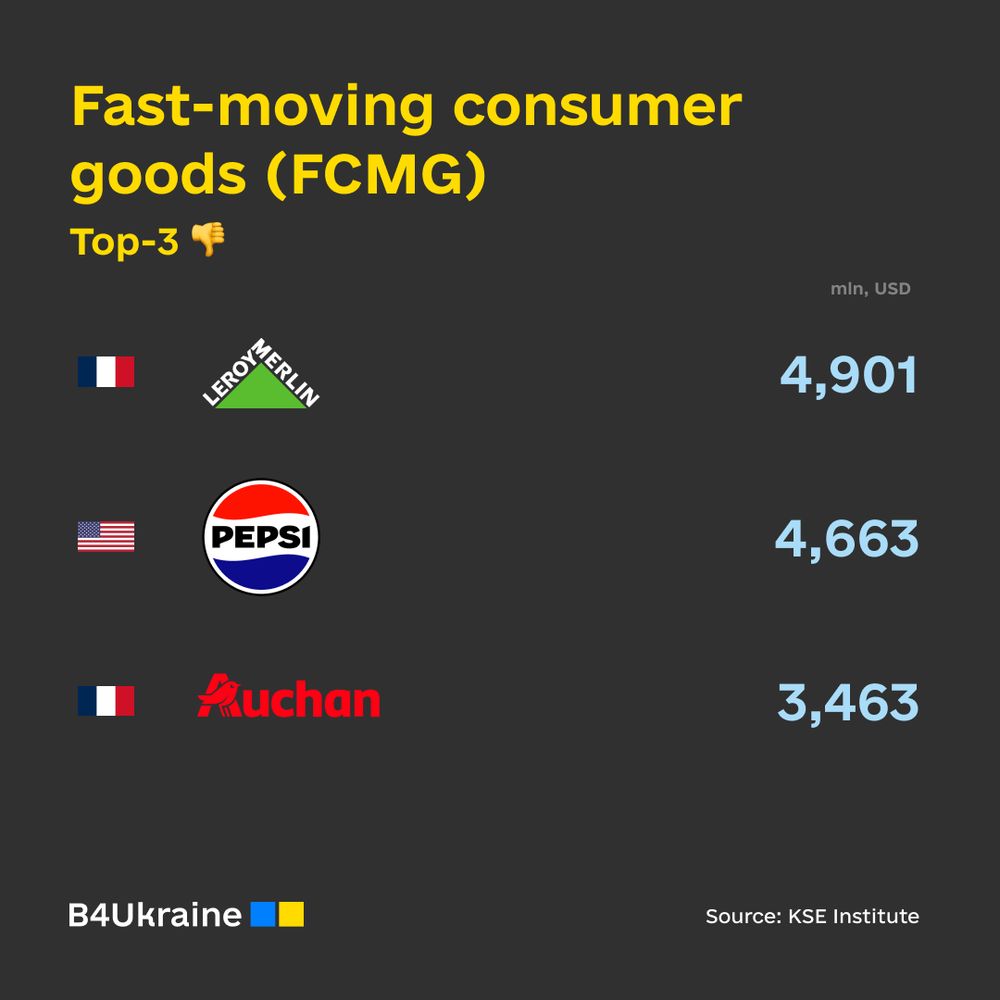

- FMCGs & “essentiality”: No more time for excuses

The fast-moving consumer goods sector (FCMG) is worth highlighting and is the second-highest revenue-generating sector, taking over $21 billion in revenue from Russia in 2022. This sector includes major global brands Danone (which made $3 billion from its Russian business in 2022), Pepsi ($4.7 billion) Procter and Gamble ($2.3 billion) and Unilever ($1.2 billion).

How do these companies defend their continued sales and revenues in Russia? In their public statements on the Russia-Ukraine war and when contacted by B4Ukraine, companies often cite the “essential” nature of the goods they supply as a justification. More recently, and in the face of sharp external criticism, companies have begun to adapt their language, citing ‘affordable, shelf-stable products’ or ‘everyday food and hygiene products’ in place of their previous ‘essentiality’ reasoning. However, they often don’t want to disclose the criteria by which they decide on the so-called “essentiality.”

- Next steps

It should be crystal clear by now: All western companies that have not left the Russian market since the full-scale invasion of Ukraine began 16 months ago are complicit in the Putin regime’s war crimes and crimes against humanity.

The only responsible course of action is to exit the Russian market and stop enabling its war against Ukraine. President Putin’s most recent comments on the Russian state wholly financing the Wagner Group of mercenaries adds urgency to conduct a responsible exit.

The B4Ukraine Coalition calls on the Biden Administration to issue a business advisory to inform individuals, businesses, financial institutions, and other persons — including investors, consultants, and research service providers — of the heightened risks associated with doing business in Russia, and particularly business activity that could benefit the Russian military.

*International companies with local subsidiaries in Russia pay a range of other taxes, including income tax on employees’ salaries, social insurance payments and VAT. Since the full-scale invasion, the Kremlin has classified a lot of financial data making it difficult to estimate the full tax bill of international companies.